Africa should lead in green Industrialization

|

| A Lithium-ion Battery |

Lithium-ion batteries power everything from your Mobile

phone to Airplane batteries. Now that the world is shifting to clean energy to

power cars, Lithium-Ion is also powering electric vehicles, EVs. The Democratic

Republic of Congo produces 70 percent of the world's cobalt, the basic Mineral in

Lithium-ion batteries.

Cathode precursor materials are the intermediate material

between cobalt and finished cathode material. Currently, precursor materials

are produced in China from the cobalt imported from D R Congo. Poland produces cathode

materials and cells, and Germany the final pack assembly.

Now D R Congo plans to upgrade its role from mining to

processing to increase its stake in the BEV industry. This beneficiation could

increase the country’s export earnings by US$54 billion a year, says Vera

Songwe, the United Nations Economic Commission for Africa's

head. “If the DRC captures 20 percent of the market

share for battery production, it will add around US$54 billion to its income

and raise its GDP tremendously,” she said.

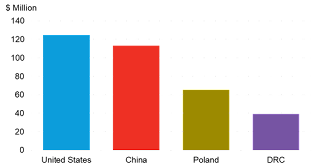

The odds are DR Congo’s favor according to a new study. The study,

by BloombergNEF, shows that building a 10,000 metric-ton battery precursor plant

in the DRC would cost $39 million. A similar plant in the US, China, and Poland

would cost an estimated US$ 120 million, $112 million, and $65 million,

respectively. This is due to its “relatively

cheap access to land and low engineering, procurement and construction, or EPC cost compared to the U.S., Poland, and China,” said Kwasi Ampofo, lead author of

the report.

Nothing stops D R Congo from expanding its role in Battery

Electric manufacturing. It can carry out the processes performed in Poland and

Germany. In fact, the creation of a Special Economic Zone could end up onshoring

all the BEV manufacturing in D R Congo in particular, and Africa in general,

with DRC as the nerve center.

Proximity to the raw materials and its reliance on

hydroelectric power plants would lower the environmental footprint. In fact, says

the report, it will lower emissions associated with Lithium-ion battery

production by 30 percent.

The battery precursor

segment is worth US$271 billion. However, the combined battery cell production

and cell assembly segments of the battery minerals global value chain are worth

a mouthwatering US$1.4 trillion.

DRC’S President Felix Tshisekedi hinted at the intention to

go big by urging his African counterparts to prioritize joint investments aimed

at increasing Africa’s share of the BEV and renewable energy value chain.

Experts at the forum echoed the President, urging Africa to

exploit AfCTA, the continental Free Trade area, to onshore other processes and

increase their share in the BEV market. The

DRC can receive other upstream mineral inputs needed for lithium-ion batteries

– such as manganese from, say, South Africa and Madagascar, copper from Zambia,

graphite from Mozambique and Tanzania, phosphate from Morocco, and lithium from

Zimbabwe, to name but a few,” say experts.

The battery and electric vehicles (BEV) value chain will be

worth US$ 8.8 trillion in 2025, rising US$46 trillion by 2050, says the

BloombergNEF report titled “The Cost of Producing Battery Precursors in

the DRC.”

The market for BEV manufacturing is wide-open, say experts.

Although there are notable leading electric-vehicle and cell manufacturers

today, the sheer scale of growth expected in the long-term throws open the

doors for competition and dominance of the new value chain. African countries

could play a major role in the lithium-ion battery supply chain by taking

advantage of their abundant natural resources and onshoring more of the value

chain.

Africa is not sitting on its laurels, Markus Thill, the vice president of the African

Association of Automotive Manufacturers (AAAM), announced at the forum that,

“AAAM is working with AfCFTA Secretariat to produce at least 5 million vehicles

in Africa for Africa by 2025.”Thill is also the President of Bosch Africa.

|

| Capital Costs compared: Congo beats hands down |

However, the continent must move swiftly. “We are only at

the beginning of the path to achieving net-zero emissions globally. Emerging

economies in Africa can gain significant long-term economic value by quickly

setting up projects that support the low-carbon transition with transparent

governance frameworks,” stated Ashish Sethia, global head of commodities at

BNEF.

Comments

Post a Comment