Who gains from debt to invest: Lender, borrower or both?

|

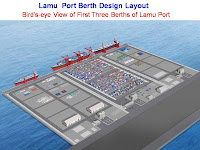

| Proposed Lamu Port: Megaprojects shift the growth curve |

If loans disbursed in full and on time, Borrower gains, If disbursed in tranches and delayed, lender gains. Some lenders opt for the latter

Does borrowing for capital formation benefit the borrower or the lender? Is there a loser or is it a win-win situation?

Does borrowing for capital formation benefit the borrower or the lender? Is there a loser or is it a win-win situation?

Recent economic data gleaned from various sources suggest that it is a win-win provided the debt is disbursed “on time and in full- and invested in capital formation.” Africa Development Bank, in its Africa Economic Outlook, 2019 provide data that supports this thesis without saying so.

However, the Outlook 2018 called on Africa to mobilize external resources to fund infrastructure development. To do this, the document called on the continent’s Planners to craft bankable projects for funding through PPPs.

The Outlook 2019 says that Ethiopia’s Debt to GDP ratio stood at 61.8 percent at the end of June 2018, the end of the 2017/18 financial year. Kenya’s ratio stood at 57 percent by the end of September 2018, says the Central Bank of Kenya. The IMF projects Ethiopia’s GDP growth rate in 2018/19 at 8.5 percent, and Kenya’s GDP growth rate was 6.1 percent in 2018, says the Central Bank.

This puts Kenya’s GDP now at $86.3 billion, and Ethiopia’s GDP at $87.4 billion at the end of June 2019. The two countries control 68 percent of East Africa’s GDP estimated $251 billion in 2017, says the Institute of Chartered Accountants in England and Wales (ICAEW). The two are also major drivers of the region’s robust growth, says the Institute.

And both also contribute the largest chunk of public debt in the region. For instance, Ethiopia and Kenya owned 43 of the 100 projects under construction in East Africa in 2017. According to the accounting firm, Deloitte. Ethiopia hosted four of the top ten projects in the region. Most of these projects are donor-funded mainly by China which funded 25.4 percent of the projects.

In contrast, Tanzania and Uganda which have fewer mega projects, have debt ratios of up to 40 percent of GDP. These two stand a distant third and Fourth largest economies in East Africa. Tanzania’s GDP, estimated at roughly $55 billion, is 64 percent of Kenya and Ethiopia’s. Uganda is even further down the ranks at position four with a GDP that is slight, over a third of the top two.

Both Uganda and Tanzania are just beginning to invest in mega Infrastructures such as SGR and hydro dams. Tanzania has just inked a US$3.5 billion contract to build a hydro dam on Rufiji River that will Generate 2.1 GW.

Tanzania and Uganda are just about to embark on a US$3.5 billion Oil Pipeline from Hoima oil fields in Uganda to the Port of Tanga in Tanzania. Such projects will increase the need for borrowing which will result in higher public debt.

This leads to the question; is there a positive correlation between GDP growth and debt sunk into capital accumulation? The robust growth in Ethiopia and Kenya is attributed to public expenditure on infrastructure development among other factors. So the answer is yes.

|

| Kenya Railway SGR: Completed ahead of schedule |

Infrastructure is rated as enablers of economic growth for they enable other sectors to thrive. For this reason, investors in enablers attract private sector investment in productive activities. Thus the creation of Industrial Parks across Ethiopia, coupled with the investment in energy and transport infrastructure, say experts has attracted investment in the industrial sector including Motor vehicle assembling and light manufacturing.

Kenya has followed more or less a similar path. So is robust economic growth the result of robust investment in infrastructure? No doubt, the answer is yes. Robust economic growth increases national wealth which creates more tax avenues, which in turn enables borrowers to pay off their debt, or so the theory goes.

This also brings to fore another truism, robust wealth creation reduces the ratio of debt to wealth. In the case of the two countries, the ratio of debt at the end of June last year compared to wealth creation has declined to 57 and 54 percent for Ethiopia and Kenya respectively. This is assuming no further debt was contracted in the intervening period.

Since wealth creation increases a country’s ability to pay off its debts, then, we can argue, Kenya and Ethiopia are not at the risk of debt distress since increasing wealth has reduced the ratio of debt to GDP by a clean 3 and 5 percentage points. The implication here is simple; since we are borrowing to invest and the investments are being completed in time and within the budget, there is no cause for alarm. Mega infrastructure projects contribute immensely to GDP growth. In some instances, they shift the growth trajectory upwards.

The experience of the two countries leads to the third question: Why did the developing countries suffer debt distress in the past? Timely disbursements of loans is a factor here. When loans are disbursed on time and in full, the target projects are likely to be completed on time and within the budget. And the benefits of such investments will contribute to further wealth creation. The reverse is also true: when loans are not disbursed on time and in full, the project implementation is likely to delay, leading to cost overruns and probably abandonment.

Africa is dotted with stalled development projects because funds ran out before the projects were completed. In such instances, the debt did not benefit the countries concerned. Since no wealth was created, debt servicing became difficult hence debt distress. The recipients were accumulating debts without creating wealth. In such circumstances, even the willingness to pay the debt was eroded. The lenders were forced to write-off the debt.

That was the case with Western Multilateral and Bilateral loans in the past: They never disbursed loans “on time and in full” leading to cost overruns and stalled projects. Africa simply accumulated debt with no commensurate wealth created.

|

| Ethiopia SGR Train built on Chinese loans |

Then the Chinese came in and began disbursing loans in full and on time. Tony Blair, the British Prime Minister up to 2006 recognized that fact. He said that China was gaining popularity in Africa because, “when Africa applies for a loan to build a road, the Chinese are there with a shovel the next day.” But other western donors buried their heads in the sand until China displaced the West in Africa as the leading development partner. According to the accounting firm Deloitte, China in 2017 financed 15.5 percent of the projects under construction in Africa, rivaling only African government which funded 27.1 percent of the projects. The West was relegated to the lower ranks funding no more than three percent of the projects.

This leads to the final question: Is the fear of looming debt distress real or is it based on experiences of the past when projects funded never contributed to wealth creation? The warnings are apt given the experiences of the past when Africa was the “Hopeless Continent.” But this is the 2000s, not the 1980s when Africa is the “Rising Continent.”

The shift in the narrative about the continent’s condition also calls for a shift in our thinking. The “hopeless continent of 1995 was dragging the global economic growth down, now it has galloped past the giants of yesteryears

True, China is not in it out of her generosity. She is in the business to create more wealth for herself. Their debt must be repaid. Consequently, Africa must protect its interest by ensuring the Projects funded by China are completed in time so that they begin contributing their “pound of blood and sweat” in the continent’s wealth creation. So far, China has excelled in removing “cost overruns and project delays” from our development vocabulary.

Comments

Post a Comment